The bright camera lights shine on her. She’s looking directly into a phone and presenting to a live audience of millions. She usually sells cosmetics, food, or electronics, but on this day in April 2020 she is selling a rocket launching service for $5.6 Million. She’s not an ordinary salesperson, but one of China’s most famous influencers, a woman named Viya.

This is the world of e-commerce livestreaming in China.

E-commerce livestreaming is nascent in the West, but incredibly sophisticated in China. Bloomberg wrote a profile of Viya on June 5, 2020 and I have seen a few articles written in the Western press about Chinese livestreaming. Most articles explain livestreaming as some kind of Chinese oddity with vague future implications for the West. To me, it’s very clear that we are looking into the future of e-commerce.

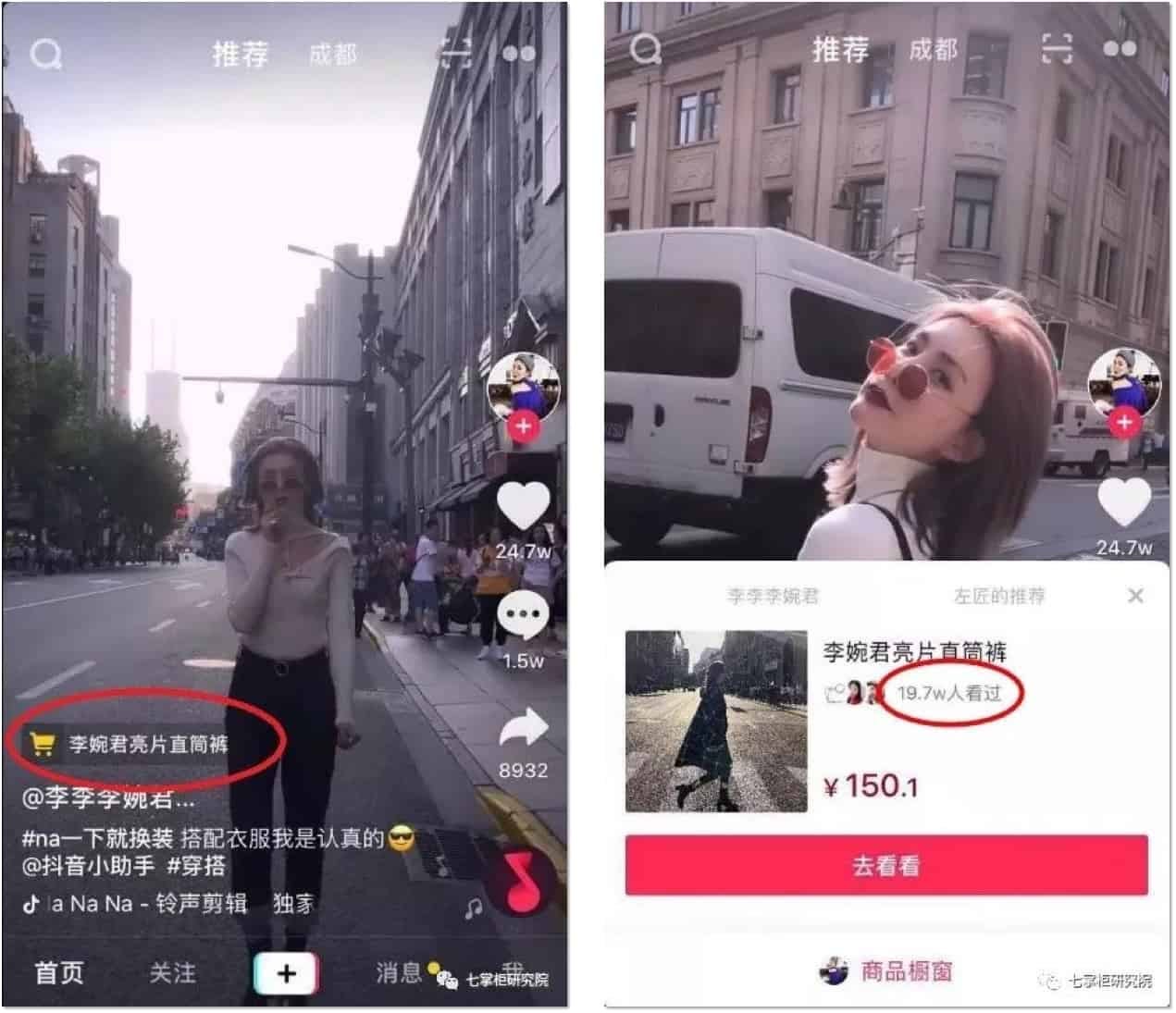

Social media influencers (known in China as KOLs, Key Opinion Leaders) use specific apps to broadcast live videos of themselves selling products to viewers. This live shopping experience occurs on a mobile device and these broadcasts often last for several hours. They are also very interactive. Viewers can ask live questions, complete their purchases in-app, and follow the intricate details of ‘the show’ being put on by the livestreamer. In 2019, livestreaming generated $63 Billion in revenue and in 2020, livestreaming is projected to generate $138 Billion in revenue.

Viya is one of the biggest livestreamers in China and is responsible for selling $6 Billion worth of products last year. For her devoted fans, Viya uses specific language, carefully choreographed show cues, and strategic giveaways to increase viewer engagement.

This experience of livestreaming taps into fundamental psychological needs. By watching a long livestream, you begin to feel a deeper connection to the featured influencer. If you develop trust in a livestreamer, you are more likely to purchase the product they are selling.

It’s like a Chinese remix on the Western concepts of infomercials and QVC. But China has fully embraced livestreaming—by March 2020, 560 Million people in China had watched a livestream, which is 62% of the country’s total internet users. This trend has accelerated due to Covid. Livestreaming has been popular in China for the last two to three years but is now expanding even more into the mainstream consciousness.

Over the last few months, some of China’s biggest companies have adopted livestreaming and sold millions of dollars worth of products. Sometimes they use KOLs and sometimes CEOs host their own livestreams. On August 16, Lei Jun, the founder and CEO of Chinese smartphone giant Xiaomi, hosted a two-hour livestream pitching products like the Mi TV and the smartphone Mi 10 Ultra. This livestream reached 50 Million people and sold $30 Million worth of Xiaomi products.

A couple of weeks ago, Viya and another major livestreamer Austin Li each hosted livestreams in honor of the upcoming November 11 Singles Day, China’s largest online shopping event. Over the course of 24 hours, Viya and Austin Li sold 1 Billion RMB worth of products, which is the equivalent of $158 Million, to an audience of nearly 300 Million viewers.

Rural Chinese farmers are also livestreaming! It’s becoming more common for farmers in remote parts of China to use their phone to start a livestream, tell stories about their products and then sell produce like fruits and vegetables.

And it’s not just native Chinese companies doing this.

Western luxury brands like Hermes, Chanel, and Prada regularly partner with livestreamers like Austin Li to help sell more products like handbags, cosmetics, and apparel to Chinese consumers. As China has been such a large driver of the global luxury market, these Western luxury companies have adopted local trends more seriously, more quickly. Now livestreaming is a major sales and marketing channel for all foreign fashion brands in China.

Personally, I love the idea of livestreaming. It’s a fun marriage of entertainment and commerce. It’s a more authentic way to sell a product vs. a classic 30-second TV ad. It’s a great manifestation of influencer marketing. I think all Western brands could learn from this, because China has ‘cracked’ livestreaming in a way that the rest of the world hasn’t.

If it happened there, can it happen here? 👀

When I worked at Facebook, there was a time around 2015 when we were actively encouraging brands and influencers to start using Facebook Live. At the time, mobile livestreaming companies like Meerkat and Periscope were getting a lot of hype and Facebook wanted to compete with them. We used to describe Facebook Live as an authentic and interactive way for public figures to interact with their fans.

I remember sitting in client meetings, pitching the idea of using Facebook Live. It was never an easy sell. Truthfully, I never understood the value of livestreaming. At the time, there was a lot of fanfare about Mark Zuckerberg’s obsession with Facebook Live but by 2018, we were no longer aggressively pushing ‘live’ to clients.

The idea of ‘going live’ never really took off as a major part of a brand’s marketing strategy in the West. We could never convey the commercial benefit of going live to your followers, and instead focused on promises of driving more engagement.

On the other hand, China approached this more pragmatically. Why do brands livestream in China? The pitch is simple—you livestream to sell your products. Back when I worked on Facebook’s Global Partnerships Team, we never pitched livestreaming as a sales channel.

While Facebook Live eventually became a sub-feature of Facebook Watch and Instagram TV, Chinese tech companies like Alibaba, Kuaishou, and Douyin were aggressively exploring livestreaming for the purposes of selling products. In 2018, livestreaming in the West became more associated with gamers on YouTube and Twitch, while livestreaming in China became more associated with e-commerce.

Last month, The Verge reported on how Western tech companies like Amazon and Instagram are now launching live shopping experiences utilising influencers, directly inspired by what’s happening in China. In July, Amazon launched Amazon Live for influencers. In August, Facebook and Instagram launched live shopping. Google has launched an adjacent product called Shoploop.

Considering the competitive landscape, the tech company most equipped to succeed in making e-commerce livestreaming popular in the West is actually TikTok. TikTok is owned by Bytedance, who owns the second largest e-commerce livestreaming app in China, Douyin. It’s obvious that TikTok’s product roadmap is at least partially inspired by Douyin. On Douyin right now, you can watch livestreams and directly buy products within the app, which could range from apparel to restaurant coupons to hotel stays.

TikTok recently announced a major partnership with Shopify and has publicly talked about their plans to get deeper into commerce. It’s not crazy to think that next year, TikTok will likely do a big push into live commerce with more institutional knowledge on the topic compared to any other Western tech company. TikTok might become the main reason why live commerce takes off in the West.

That’s a big deal, because the prevailing wisdom is that innovation flows from the West to the East, not the other way around.

Where is the Future of Tech? 🌏

In December 2018, a16z partner Connie Chan wrote an amazing article called “Outgrowing Advertising: Multimodal Business Models as Product Strategy.” It was a formative article that led me down the rabbit hole of Chinese tech. She wrote about the different ways consumer tech companies in China approached monetisation.

Celebrities and authors can make money by selling virtual gifts to their fans. Musicians can host private virtual concerts or live karaoke rooms where people can offer digital tips. Podcasters often charge subscriptions and gamify the listening experience, allowing people to ‘level up’ with each additional purchase. Streaming platforms can place targeted product placements in videos that people can click on to make a purchase. Those same viewers can also download digital coupons to spend at local restaurants.

Nearly two years after reading her article, none of these approaches have become mainstream in the West. Why…?

Compared to the West, China has a much more robust mobile payments infrastructure through platforms like AliPay and WeChat Pay, and credit cards are less popular in China. Paying for almost anything through your phone is a lot easier and more socially acceptable in China vs. the West. That might explain how it’s more difficult to facilitate digital payments in America.

Another way to explain major differences in Eastern/Western consumer tech has to do with culture. China has a very young consumer market. Trends and behaviours are less influenced by history than America, which has had over a hundred years of modern consumer culture to create precedent and tradition. This includes the strength of advertising agencies in America who heavily influence the business models of tech companies like YouTube and Facebook.

Or maybe tech companies in the West underestimate the level of innovation coming from China and the ability to learn from Chinese tech. One of my former interview guests told me the biggest misconception people in the West have is that Chinese tech companies are only copycats who steal intellectual property and create nothing new.

You can see this in popular culture as well. HBO’s TV Show Silicon Valley had a main character Jian-Yang, who was a wild Chinese caricature. During one storyline in 2018, Jian-Yang fled America to go to China in order to set up a dramatic, smoke-filled sweatshop where he abused his staff and created clones of every famous Silicon Valley tech company.

There’s a Western cultural hang up that diminishes the Chinese ability to innovate. While there are plenty of examples of Chinese tech companies ruthlessly copying Western counterparts over the last two decades, that is less prevalent in 2020 when you can see Chinese companies being world-class innovators.

The most glaring example of this is TikTok, a Chinese company that has been so disruptive that even the President of the United States tried to shut it down. I am certain, however, that TikTok is the first (and not the last) major Chinese tech company to so deeply penetrate Western consciousness.

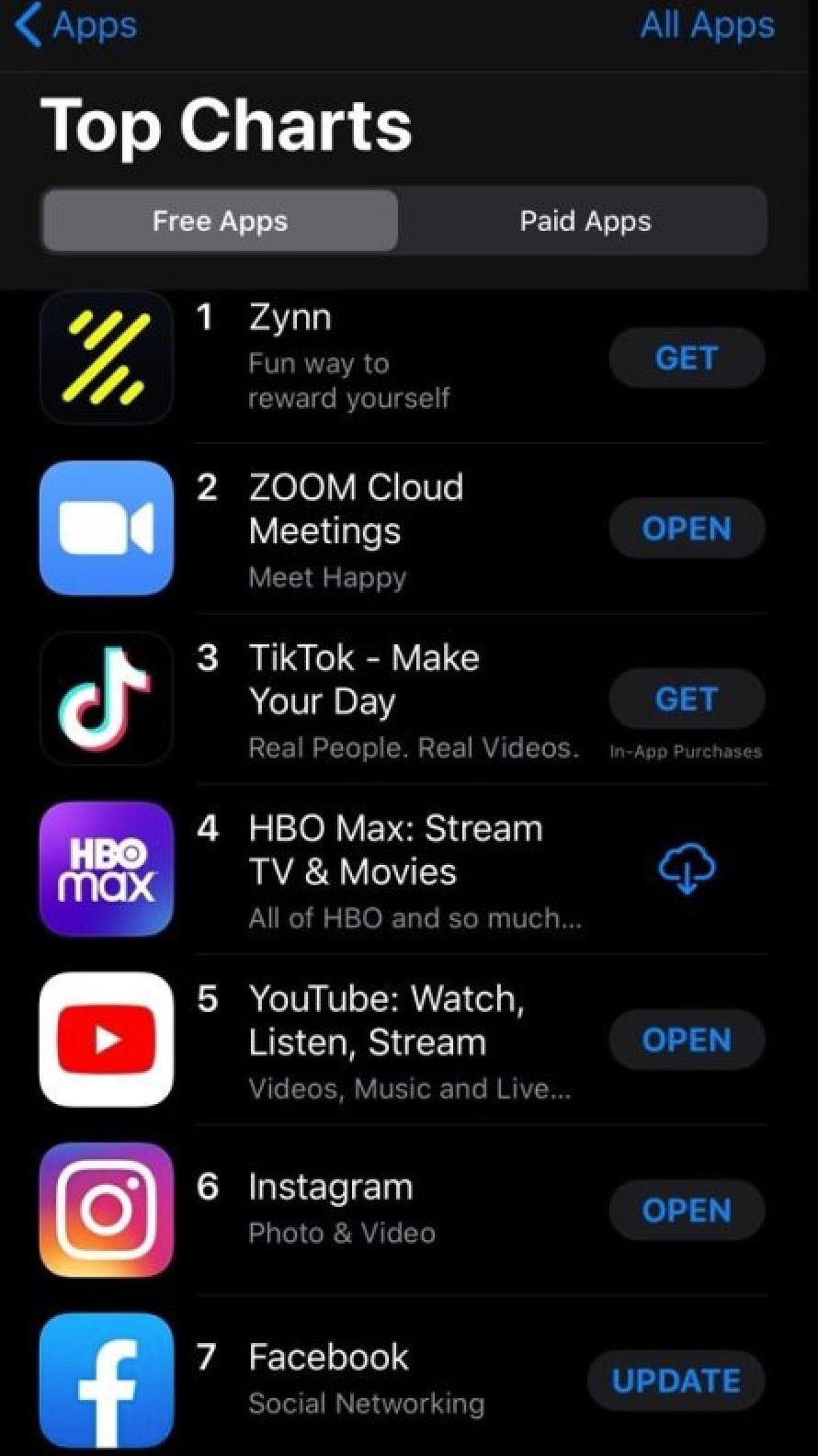

For a brief time earlier this year, the number one mobile app on the US App Store was Zynn. Zynn was essentially a TikTok clone funded by the company Kuaishou, which is one of TikTok’s biggest rivals back in China.

One of the biggest e-commerce companies in the US right now is Shein. A recent survey found that Shein is the second most popular online retail brand for Gen-Z Americans, ahead of Nike, Lululemon, and Urban Outfitters. The company was founded in Nanjing, China in 2008 and generated $2.8 Billion in revenue last year.

This leaves us at the crux of another megatrend people might start feeling uncomfortable with—the declining influence of American technology.

This past month, tech analyst and investor Benedict Evans wrote an article called “The End of the American Internet.”

Comparing the internet of 2020 to the internet of the 1990s, Evans points to the fact that now 80-90% of internet users are outside the US. China and India have 5x more smartphones than the USA. The share of venture capital startup investments outside the US has also been steadily increasing over the last decade.

Whether you think Chinese livestreaming is a silly fad or a profound shift in retail, there are certain realities we all have to contend with.

If you want to see the biggest shifts in the global economy, you need to study China and you need to understand the future of Asia. Modern Asia is a much more impressive and exciting place than at any other time over the last fifty years. You need to start learning from outside of the West.

So what can we learn from Chinese livestreaming? The future.