Update #88 - Big Asian Companies, Sports and Entertainment

Make sure you subscribe to receive new updates!

Welcome to East West Hurricane! 🌪

We update you on the most essential news from Asia in tech, media, and business—the things you need to know that you probably haven’t heard in Western media.

Please share this newsletter with a friend! ⚡️

Getting Big in Asia and the West

Ant Group, China’s biggest fintech company, was scheduled to IPO this Thursday on both the Shanghai and Hong Kong Stock Exchanges. However, at the last minute the IPO was delayed, due to recent decisions from Chinese regulators.

Chinese regulatory bodies cited Ant’s failure to sufficiently meet certain financial reporting requirements as the primary reason why they had to delay the IPO. Considering this announcement came two days before the IPO, people reading between the lines are seeing tensions between Ant and the Chinese government. Ant Group is so big and powerful that it rivals China’s biggest state-owned banks.

This was supposed to be the largest IPO in history, with Ant Group aiming to raise $35 Billion on a valuation of $310 Billion. While the IPO delay has caused Ant’s valuation to decrease by $60 Billion, Ant might still go public at some point (?) in the near future. Ant executives are meeting with the China Securities Regulatory Commission (CSRC) on Monday to discuss the next steps.

You could look at Ant and think this is the biggest, most disruptive Chinese tech startup to ever exist. Some people might really want Ant to face more regulation.

Meanwhile in India, Reliance is continuing to operate as the most valuable Indian company, and seems to get more powerful every day. Reliance Jio, the Indian telco/digital platform, has now 400 million subscribers at the end of last quarter. This makes Reliance the only telco in the world outside of China to have 400+ million subscribers.

Reliance, the parent company of Jio, has also received a $1 Billion investment from Abu Dhabi and Saudi Arabian investment funds to create new fiber optic broadband cable infrastructure around India. Reliance already operates 1.1 Million kilometers of fiber within the country and is likely the most influential Indian company in the world.

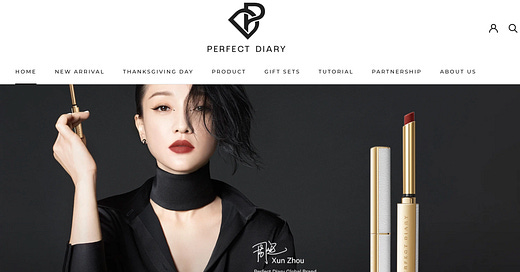

While Ant is put on pause, another major Chinese IPO goes ahead. Yatsen Holding Ltd is about to make history as the very first Chinese beauty company to list on the New York Stock Exchange. Yatsen owns cosmetics and skincare brands like Perfect Diary, Little Ondine and Abby’s Choice. The company has served 23.5 Million DTC customers this year and is valued at $4 Billion.

Many luxury fashion and beauty brands consider China to be their most important market. As a recent example, luxury brand Louis Vuitton has picked Wuhan as the first city to host their upcoming global exhibition “See LV.” This is seen as a move by the brand to show their confidence in China’s economic recovery and reaffirm the overall importance of China as a market for luxury fashion.

So it’s remarkable to see a Chinese beauty brand (Yatsen) do so well and list on the New York Stock Exchange. If local Chinese brands can provide a viable alternative to Western brands, there’s a huge opportunity to capture the hearts and minds of Chinese consumers.

Other Chinese companies continue to grow and expand internationally. The most controversial and impactful Chinese company in the West has been TikTok. TikTok recently announced plans to hire 3,000 more engineers over the next three years, primarily in Singapore, Europe, and Canada.

TikTok’s parent company Bytedance is continuing to act like an app factory and TikTok is just one out of a dozen apps they operate.

Last week, Bytedance held a press conference announcing the new brand Dali Education, which covers all of Bytedance’s current education businesses such as Gogokid, Qingbei, and Open Language. Edtech is a hot, fast-growing industry in Asia, and it’s a major priority for Bytedance.

As an example, here is the Dali smart lamp from Bytedance, which is a technology to help connect teachers and students!

Asian Sports and Entertainment Approaching a New Normal

Last week, 250 fans in Singapore were able to attend “One: Inside the Matrix,” the country’s first live sports event in months. Hosted by ONE Championship, Asia’s biggest mixed martial arts promotion, the event took place in an indoor stadium. Fans had to get Covid antigen tests before entering the stadium, which gave them results within 15 minutes. The Singaporean government is hosting a rapid testing pilot program to allow more events like this to become the new normal for sports events.

The League of Legends World Championship was hosted in Shanghai last week. 3.2 Million people applied for tickets to attend the live event, which was hosted in an arena operating under capacity to allow 6,300 people to attend. Chinese teams had won the last two years but the Korean team Damwon were the winners this year. It’s estimated that 100 Million people from around the world were watching the livestream. This is the biggest e-sports event in the world and involves huge sponsors like Mercedes-Benz and Louis Vuitton.

Within the other parts of the gaming world, the most popular and highest grossing mobile game has been PUBG. The game is created by Krafton, a Korean company whose second largest shareholder is Tencent. Krafton is reportedly planning to have an IPO next year, which might end up being one of Korea’s biggest IPOs of all time.

Meanwhile, there’s a new game Genshin Impact that just came out in September and already has 200 Million downloads and accumulated $245 Million in player spend. The US has been the third biggest market for Genshin Impact, with US players spending $45 Million in the game over the last month. Genshin Impact is created by Chinese game developer miHoYo and overtook PUBG last month in terms of users and revenue. The gaming industry continues to be dominated by Asian companies and the impact continues to extend to the West.

If you enjoyed this, please share this newsletter with a friend! 😁

You can reach out to me and find more of my work here on Linktree…!