Welcome to East West Hurricane! 🌪

We update you on the most essential news from Asia in tech, media, and business—the things you need to know that you probably haven’t heard in Western media.

Follow us on Twitter and Instagram! ⚡️

Kuaishou and Tencent are Latest Livestreaming Darlings 👾

Kuaishou, the Chinese short-form mobile video app, has revealed their latest data around active users and engagement. They announced that they gained 70 Million more daily active users in the first half of 2020. At the end of last year, Kauishou only had 100 Million users, meaning the company has grown 70% over six months. One of the main reasons people use Kuaishou is for livestreaming, which furthers the narrative that livestreaming is truly exploding this year because of the coronavirus. Kuaishou’s biggest rival is likely Douyin, the Chinese equivalent of TikTok owned by same parent company Bytedance. Douyin and other rivals like Douyu, Huya, and Joyy also experienced strong growth this year.

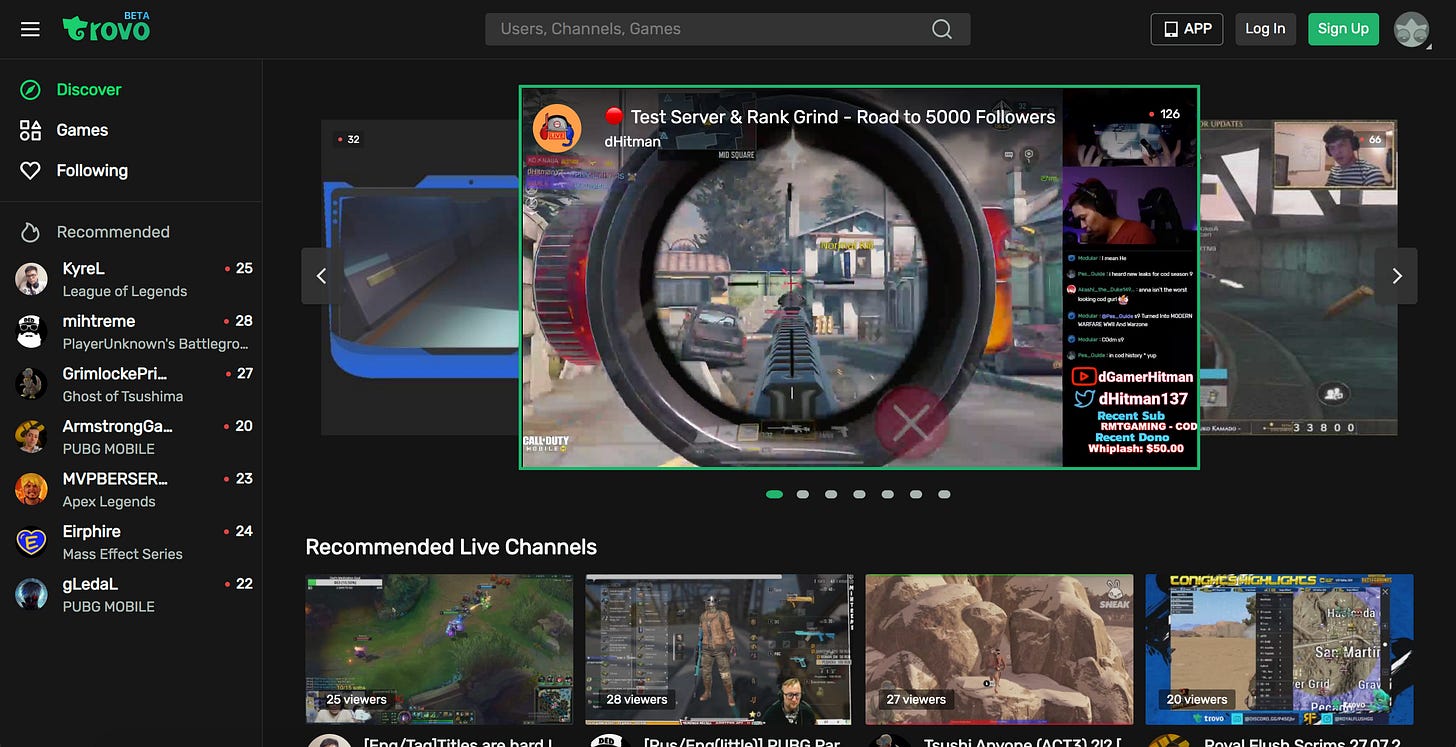

Tencent, the Chinese tech giant that is technically the world’s largest gaming company, has been beta testing a gaming livestreaming platform called Trovo Live. This is seen as a direct competitor to the Amazon-owned livestreaming platform Twitch. Trovo also announced a $30 Million partnership fund this month to help support creators on their platform. It’s an interesting investment for Tencent, as they are also investors in Douyu and Huya. In recent weeks, Microsoft has shut down their gaming livestreaming platform Mixer and Twitch has been hit by several sexual harassment allegations. Facebook Gaming has benefitted the most from these developments with creators migrating to their platform instead. So Livestreaming, whether for e-commerce, gaming or anything else, continues to grow.

Premier League Matches Taken Down in China ⚽️

The final match of the English Premier League on July 22 between Liverpool and Chelsea was taken off CCTV, China’s largest state-run broadcaster. The match was demoted to a lesser known channel and it’s unclear whether future Premier League matches will still be shown on CCTV. This likely results from the UK government’s recent decision to ban Huawei from building 5G infrastructure as part of the ongoing trade war.

In terms of media rights, China is the Premier League’s second largest international market and a major strategic priority. The deal between the Premier League and their Chinese broadcast partner is worth $700 Million over a three-year period. There is a lot of hype for all sports leagues, especially European football leagues, to see China as their most valuable, under-tapped market. While foreign leagues can put together detailed and ambitious plans for China, political machination always have to be considered. Just ask the NBA.

The Opportunity for Indian Family Offices 🏦

After the Indian government’s recent bans of Chinese apps and new regulations on foreign investment, many Chinese investors are unsure how to proceed in the Indian market. In this vacuum, Indian family offices will play a key role. A report found that India had 150,000 ultra-high net worth (UHNW) families in 2018 with a cumulative net worth of $2 Trillion. That number is expected to rise to 400,000 families with a cumulative net worth of $5 Trillion by 2025. Family offices are usually professionally run investment funds set up to manage a family’s wealth.

Across the world, family offices have been getting more interested in tech startup investments and this KrAsia article interviews several Indian investors for their first hand perspective on the topic. Family offices have historically stuck to more traditional investments like real estate until a 2012 regulation allowed Indian private equity and venture capital to raise funds more easily from Indian investors. This paired with the maturing Indian tech ecosystem and now the tensions with China leaves a major opportunity for family offices to make more direct investments into the new high-risk/high-reward ‘asset class’ of tech startups. No matter where the money is coming from, this is good news for any Indian startup knowing that their pool of potential investors is increasing.

Share this post