Welcome to East West Hurricane! 🌪

We update you on the most essential news from Asia in tech, media, and business—the things you need to know that you probably haven’t heard in Western media.

Follow us on Twitter and Instagram! ⚡️

I’ve recently joined the OnDeck Writer Fellowship. I’ve met some great people and received some amazing advice regarding the frequency of posting newsletters.

As per some feedback, I’m going to experiment with sending a news update on a weekly basis, rather than daily. It has taken A LOT of work to write 86 weekday updates over the last few months, and I think a weekly update should provide the same level of value.

Of course, I will still be having interviews and longer-form analysis on topics in Asian tech, media, and business.

Always feel free to reach out and give me any feedback!

Everything is Bigger in China

A few months ago, I read an article in the Financial Times called The Asian century is set to begin. It sounds pretty obvious, but the FT put together the most cohesive, data-driven argument I had ever seen on the rise of China.

Last week, billionaire hedge fund investor and macro-thought leader Ray Dalio wrote an article in the FT called “Don’t be blind to China’s rise in a changing world.” It’s another amazing article that succinctly summarizes why you should care about China.

In the US, there’s a saying that “everything is bigger in Texas.” My takeaway about the modern world today is that “everything is bigger in China.’

In 2020 so far, 23 Chinese companies have gone public on American stock exchanges, 180 companies have gone public on the Shanghai Stock Exchange, 115 in Shenzhen and 99 in Hong Kong.

Ant Group, a financial services company spun out of Alibaba, is in the process of going public on the Hong Kong and Shanghai Stock Exchange. This will be the biggest IPO of all time, with the company aiming to raise $34.5 Billion on a $313 Billion valuation.

The last biggest IPO in the world was Saudi Arabia’s Aramco, which raised $29 Billion last year.

Many investors are betting on Ant Group as a bellwether for the Chinese economy, as Ant Group is essentially the biggest fintech company in China, a country of 1.4 Billion people who likely all need financial services.

At the same time, Bytedance is making plans to take their short video app Douyin public, either in Hong Kong or Shanghai. Douyin is the Chinese version of TikTok, so does this mean a TikTok IPO comes next? Probably.

I don’t think it’s hard to see that TikTok is following the path of Douyin, which is probably 18 months ahead of TikTok in terms of product development. As an example, TikTok just announced a partnership with Shopify to have a more integrated social commerce experience on the app.

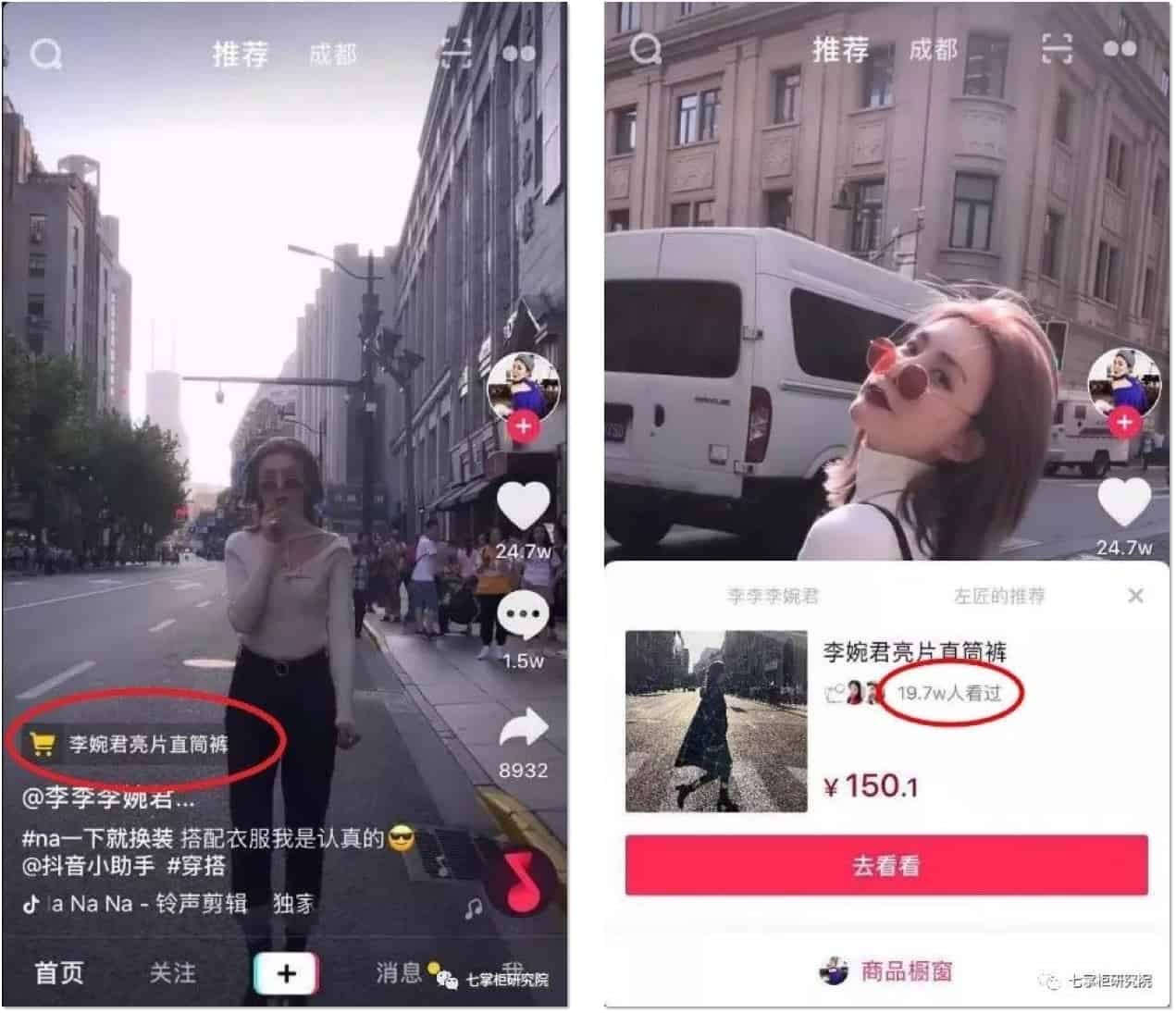

Douyin has had much deeper social commerce features for a while. As described in an article from SupChina last year, people on Douyin can directly buy products on the app after watching a video. You can also book hotel stays on Douyin, or coupons for restaurants.

If you believe that TikTok follows Douyin’s lead, it’s kind of obvious to think what comes next in TikTok’s product road map…

Western Investments

People working at Snapchat are probably in a good mood right now, as the company reported positive results at their most recent earnings call last week, which sent their stock price to all time highs of $44 a share.

A big part of Snap’s focus is India, where their user numbers have grown 150% year-on-year. India is Snap’s biggest market outside of the US. Snap has created augmented reality training programs in Indian schools, Indian content on the app, and support for nine Indian languages.

In Vietnam, Apple is building new factories and employing Vietnamese workers as part of their new supply chain. This has caused an increase in wealth within several rural Vietnamese towns who have experienced a local boom thanks to investment from Apple.

Sheldon Adelson, the Las Vegas casino billionaire, is considering selling $8 Billion worth of his casino empire to focus exclusively on his properties in Macau and Singapore. For Adelson’s company Las Vegas Sands Corp, 63% of their revenue comes from Macau and 22% comes from Singapore. In the case of Adelson, the US might be too small a market for him to have as his focus.

In line with this trend, China’s Box Office has suddenly become the world’s biggest for the very first time. In major part due to a quick Covid recovery, the Chinese film industry is functioning right now and has brought in more revenue this year than the US film industry. While still not at its full strength, Chinese cinema currently has a more predictable recovery plan vs. its US counterpart.

We should also remain mindful of the fact that international perception of China is at an all-time low. Pew Research has released a report saying that many countries around the world like Australia, the UK, and Japan now have historically unfavourable views of China, partly due to the country’s response to Covid.

The Rising Global Internet

I’ll close with this. Benedict Evans, one of the world’s leading tech analysts, has written an article called The End of the American internet. Here are the opening two paragraphs.

“When Netscape launched in 1994 and kicked off the consumer internet, there were maybe 100m PCs on earth, and over half of them were in the USA. The web was invented in Switzerland, and computers were invented in the UK, but the internet was American. American companies set the agenda and created most of the important products and services, and American attitudes, cultures and laws around regulation and speech dominated.

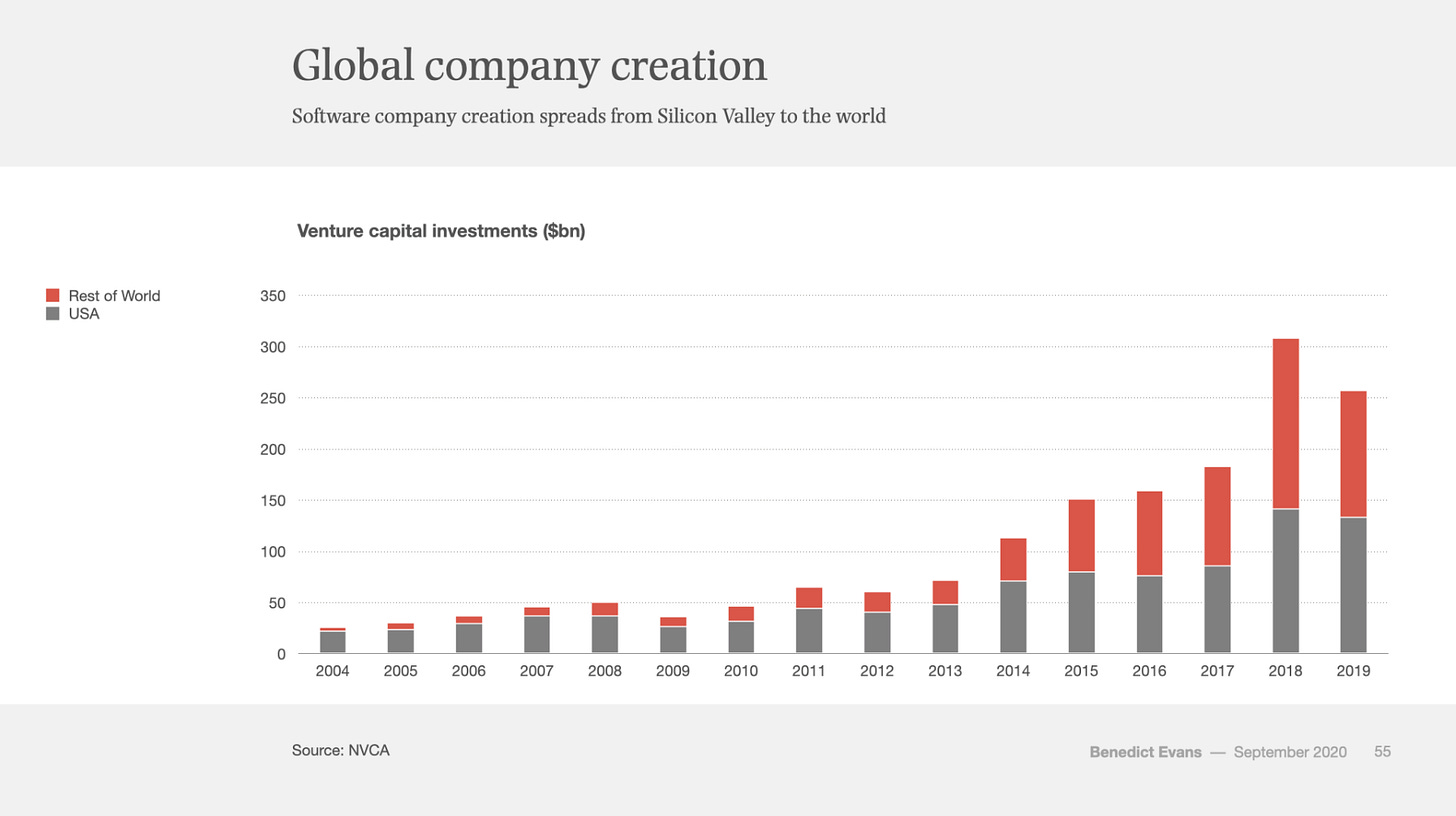

This is not quite so true anymore. 80-90% of internet users are now outside the USA, there are more smartphone users in China than in the USA and western Europe combined, and the creation of venture-based startups has gone global.”

You can find more of my work here on Linktree…

Share this post